Our Sectors

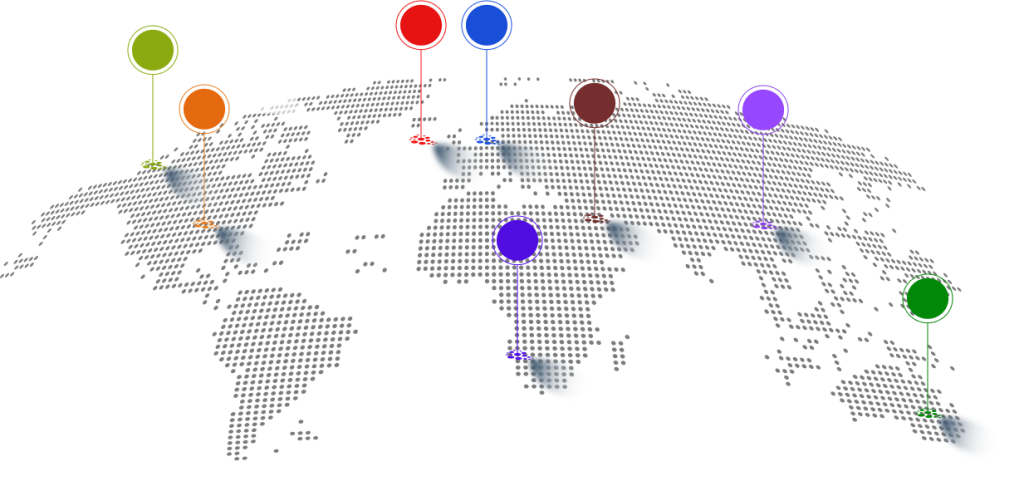

OUR REGIONS

We are proud to support companies on their journey towards greater inclusivity across the globe. Our solutions are currently available in the USA, Canada, Hong Kong, Abu Dhabi, South Africa, Europe, the UK, and Sydney. No matter where your business operates, Honordex provides the tools and insights needed to foster a more inclusive and socially sustainable workplace.

Honordex tracks over $5 trillion in assets covering 500+ funds and entities.

Venture Capital (VC)

Honordex measures over 150 global VC funds with over $1bn AuM. VC is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but significant potential for growth. Fledgling companies sell ownership stakes to venture capital funds in return for financing, technical support and managerial expertise. VC has an outsized impact on innovation, technology and the economy.

Fintech

Fintechs—short for financial technology—are companies that rely primarily on technology to conduct fundamental functions provided by financial services, affecting how users store, save, borrow, invest, move, pay, and protect money. They are one of the fastest growing sectors, with several of the PE and VC funds investing, which is why we have added it to Honordex. To date we have over 25 Fintechs ranked.

Higher Education (HE)

HE Honordex measures over 160 UK Universities. The expansion to this sector was funded through the Innovate UK, Inclusive Innovation grant in 2024. The reason for expansion to this sector, was to deepen our expertise and impact through the pipeline development of the next generation.

Higher education is a rich cultural and scientific asset which enables personal development and promotes economic, technological and social change. It promotes the exchange of knowledge, research and innovation and equips students with the skills needed to meet ever-changing labour markets. For students in vulnerable circumstances, it is a passport to economic security and a stable future.

–(UNESCO)